September 23, 2025

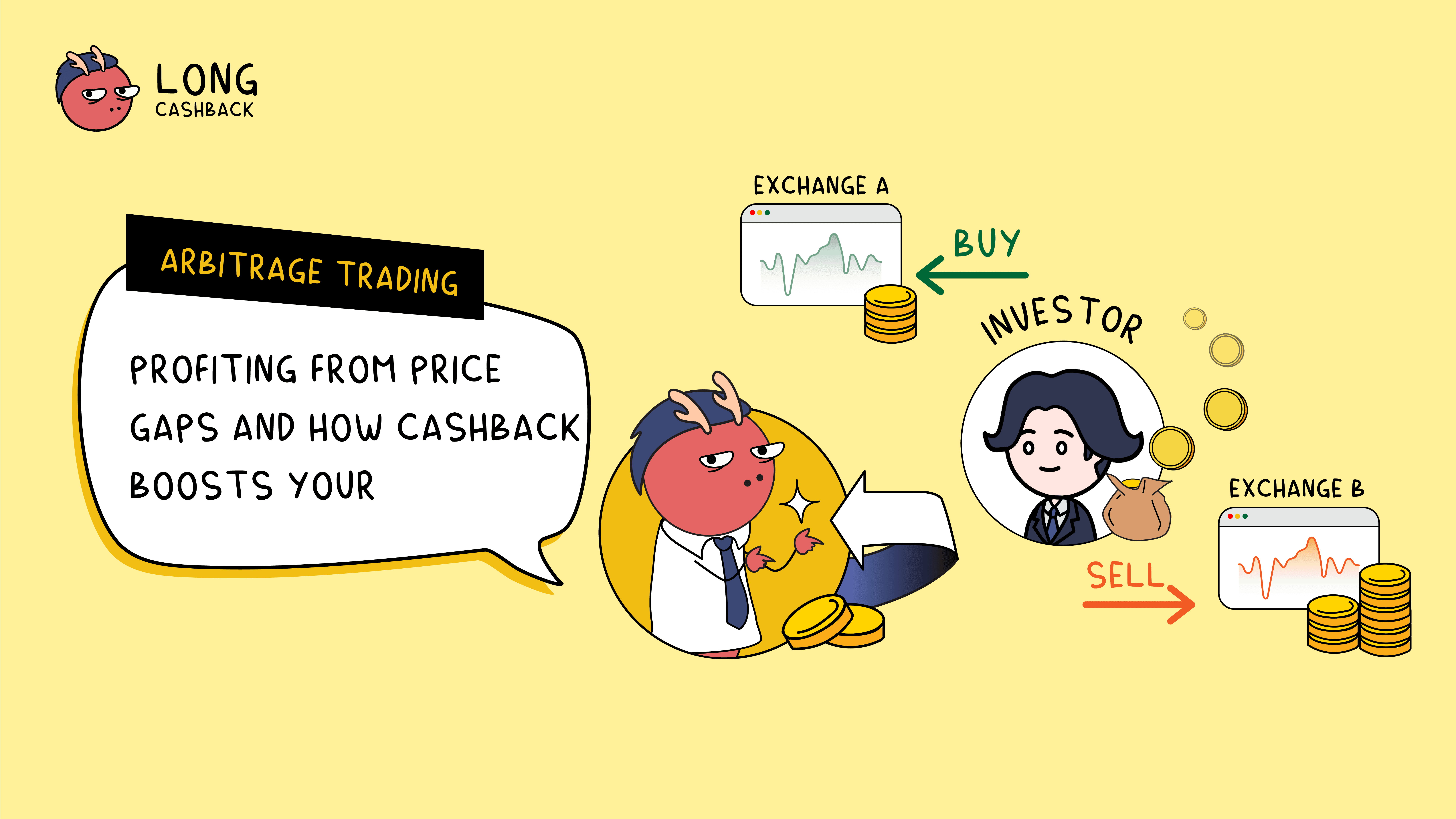

Arbitrage trading is one of the oldest financial strategies, now widely used in the crypto market. The idea is simple: buy low in one place, sell high in another, and profit from the price difference.

For example: if BTC trades at 60,000 USDT on Exchange A but 60,200 USDT on Exchange B, buying on A and instantly selling on B gives you 200 USDT profit per BTC.

In crypto, arbitrage opportunities are frequent because the market runs 24/7 and each exchange has different spreads, liquidity, and fees.

Buying on one exchange and selling on another. The most basic and widely used form.

Within the same exchange, exploiting price mismatches between trading pairs, e.g. BTC/USDT → ETH/USDT → ETH/BTC.

Taking advantage of differences between spot and futures prices. For example, if futures are trading at a premium, traders can short futures and long spot simultaneously.

Using decentralized exchanges (DEX/AMMs) to exploit differences in liquidity pools. Often automated with bots or flash loans.

Arbitrage sounds attractive, but here’s the catch: fees often decide whether you win or lose.

👉 In short: arbitrage works, but without managing fees, your strategy may collapse.

This is where cashback becomes a game-changer.

Cashback refunds part of the trading fee you pay. For instance, if your taker fee is 0.1% but you receive 50% cashback, your effective fee drops to 0.05%. That’s a direct boost to your net ROI — crucial when arbitrage margins are thin.

→ Instead of “just reducing costs,” cashback directly turns thin trades into profitable trades. In some cases, cashback can even flip a losing arbitrage into a winning one.

Arbitrage is fundamentally a low-margin, low-risk strategy, but only sustainable if you control costs.

Without cashback, you’re leaving half your potential profit on the table.

With arbitrage + Long Cashback, you maximize spreads and reduce trading fees — boosting net ROI without adding market risk.

👉 Smart traders don’t just hunt arbitrage opportunities; they also optimize fees on every trade. That’s exactly what Long Cashback is built for.

Can retail traders compete with whales by farming cashback using bots? This article breaks down how cashback works, the role of bots, and whether optimizing fees can meaningfully improve net ROI.

tradingfutures cashbackcrypto

A practical approach to crypto trading that combines Grid Bots, Copy Trading, and Cashback to improve net ROI, reduce fees, and build a more resilient trading system.

grid bot gridtrading cashbackcrypto copy trade futurestrading

Cashback has become the “safest form of profit” that many pro traders optimize before even thinking about trade-based gains. Market-independent, stable, and risk-free, cashback reduces costs, boosts real PnL, and provides a long-term competitive edge for anyone trading consistently.

longcashback cryptocashback futurestrading tradingstrategy cryptotradingfee